Property Taxes in Toronto and Surrounding Communities

Property taxes represent a significant ongoing expense for homeowners in the Greater

Toronto Area. These taxes fund essential municipal services and vary considerably

between different communities. Understanding the property tax landscape is crucial for

budgeting and making informed decisions about where to purchase property.

Property Tax Rates by Municipality

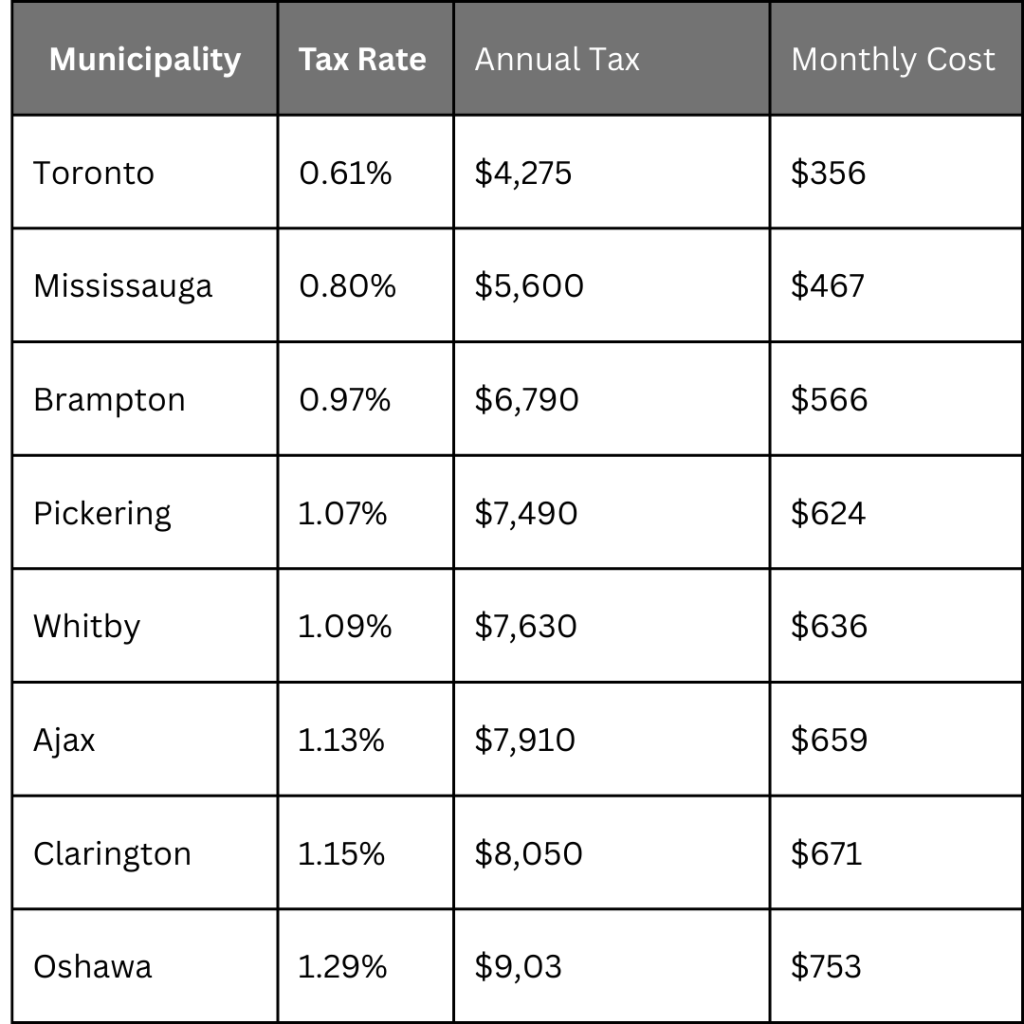

Understanding property tax rates is essential when budgeting for homeownership in the Greater Toronto Area. Here’s a straightforward breakdown of what you can expect across different municipalities in 2025:

City of Toronto

Toronto maintains one of the lowest residential tax rates in the GTA at approximately 0.7541% of your property’s assessed value. For perspective, the owner of a home assessed at $700,000 would pay about $5278 annually. The city offers flexible payment options including monthly pre-authorized payments, installment plans, or an annual lump sum payment. Toronto also provides tax relief programs for low-income seniors and persons with disabilities who qualify.

Durham Region

Property tax rates in Durham Region are generally higher than Toronto but vary by municipality:

- Oshawa: 1.29% of assessed value

- Whitby: 1.09% of assessed value

- Ajax: 1.13% of assessed value

- Pickering: 1.07% of assessed value

- Clarington: 1.15% of assessed value

While these rates are higher than Toronto’s, the lower average property values in Durham often result in comparable or even lower actual tax payments for similarly sized homes.

Toronto’s Former Municipalities

North York, Etobicoke, and Scarborough are all part of the amalgamated City of Toronto and share the same 0.61% tax rate. However, your actual tax bill will vary based on your property’s assessed value:

- North York: Higher average property values in certain neighborhoods typically result in higher tax bills despite sharing Toronto’s rate.

- Etobicoke: Property values vary widely across neighborhoods, directly affecting the actual tax amount.

- Scarborough: Generally lower property values compared to central Toronto often translate to lower tax bills.

Peel Region

- Mississauga: With a residential tax rate of approximately 0.80%, a $700,000 property would incur about $5,600 in annual taxes. The city offers monthly, quarterly, or annual payment options and provides tax deferral programs for eligible seniors and low-income residents.

- Brampton: At approximately 0.97% of assessed value, property taxes are higher than both Toronto and Mississauga. A $700,000 property would result in roughly $6,790 annually. Brampton offers pre-authorized payment plans, installments, or annual payment options, along with tax assistance programs for eligible seniors and persons with disabilities.

When comparing communities, remember that the actual tax amount depends on both the tax rate and your property’s assessed value. Areas with lower rates but higher property values may result in tax bills similar to areas with higher rates but lower property values.

Assessment Process

Property taxes are based on the assessed value determined by the Municipal Property

Assessment Corporation (MPAC):

How Properties Are Assessed

- MPAC conducts province-wide assessments every four years

- Current values are based on the January 1, 2024 valuation date

Assessments consider: - Property size and dimensions

- Age of the property and any renovations

- Location and neighborhood factors

- Property type and construction quality

- Market conditions at the valuation date

Assessment Appeals

If you believe your property assessment is incorrect:

assessment notice- If unsatisfied with the RfR result, file an Appeal with the Assessment Review

Board (ARB) - Provide evidence supporting your claim, such as:

- Comparable property sales in your area

- Property condition issues not reflected in the assessment

- Factual errors in MPAC’s property description

- Recent private appraisals

Phased-In Assessment Increases

To minimize the impact of significant assessment increases: * Assessment increases are

typically phased in over a four-year period * Decreases in assessment value are applied

immediately * This system helps prevent dramatic tax increases due to rapidly rising

property values

Payment Options and Schedules

Municipalities offer various payment methods to accommodate different preferences:

Pre-Authorized Payment Plans

- Monthly plans: Equal payments withdrawn automatically throughout the year

- Installment plans: Automatic withdrawals on scheduled due dates

- Benefits: Avoid late payment penalties and simplify budgeting

- Enrollment: Available through municipal websites or tax offices

Installment Options

- Most municipalities offer 2-6 installments per year

- Due dates vary by municipality but typically include payments in:

- February/March

- May/June

- August/September

- October/November

Annual Payment

- Single lump-sum payment

- Often due in February or March

- May qualify for early payment discounts in some municipalities

Payment Through Mortgage

- Many lenders offer property tax payment as part of mortgage payments

- Taxes are collected monthly with mortgage payment

- Lender remits payment to municipality on due dates

- Simplifies budgeting but may include administration fees

Tax Rebates and Incentives

Several programs can help reduce property tax burden:

First-Time Homebuyer Rebates

- Toronto Land Transfer Tax Rebate: Up to $4,475 for eligible first-time buyers

- Ontario Land Transfer Tax Rebate: Up to $4,000 for eligible first-time buyers

- Combined savings: Up to $8,475 for properties in Toronto

- Eligibility: Must be a first-time homebuyer and occupy the property as principal residence

Home Renovation Tax Credits

- Home Accessibility Tax Credit (HATC): Federal credit for seniors and persons with disabilities

- Seniors’ Home Safety Tax Credit: Ontario credit for seniors’ home modifications

- Energy efficiency rebates: Various municipal and utility provider programs

Heritage Property Tax Reduction

- Properties designated under the Ontario Heritage Act may qualify for tax reductions

- Typically 10-40% reduction in property taxes

- Requires maintenance of heritage features

- Application through municipal heritage departments

Vacancy Rebate Programs

- Some municipalities offer rebates for vacant commercial and industrial properties

- Residential vacancy rebates have been largely eliminated

- Requirements include minimum vacancy periods and application deadlines

Comparison of Tax Rates Across Communities

Understanding the relative tax burden can influence purchase decisions:

Effective Tax Rate Comparison

For a property with an assessed value of $700,000:

Value Proposition Analysis

When considering property taxes in purchase decisions:

- Toronto: Lowest tax rate but highest property values

- Durham Region: Higher tax rates but lower property values

- Mississauga: Moderate tax rate with high property values

- Brampton: Higher tax rate with more moderate property values

The total cost of ownership should consider both purchase price and ongoing tax

obligations.

Future Tax Considerations

Several factors may impact future property tax obligations:

Planned Rate Changes

- Most municipalities have published multi-year budget plans

- Toronto has committed to keeping increases at or below inflation

- Durham Region municipalities have projected increases of 2-4% annually

- Mississauga and Brampton have indicated 3-5% increases in coming years

Infrastructure Development Impact

Major infrastructure projects often influence property taxes: * Transit expansions *

Community center developments * Road and utility upgrades * New school construction

Reassessment Impacts

The next province-wide reassessment will reflect market changes: * Areas with rapid

appreciation may see larger increases * Phased-in implementation helps mitigate

immediate impact * Different property types may be affected differently

Tax Planning Strategies

Several approaches can help manage property tax obligations:

Verification of Assessment Accuracy

- Review your property assessment notice carefully

- Compare with similar properties in your neighborhood

- Ensure all property details are correctly recorded

- Request reconsideration if discrepancies are found

Timing Purchase Decisions

- Property tax adjustments are typically made at closing

- Purchasing later in the tax year can defer large initial payments

- Understanding payment schedules helps with cash flow planning

Renovation Considerations

- Major renovations can trigger reassessment

- Energy efficiency improvements may qualify for rebates

- Heritage designations may provide tax advantages

- Timing renovations around assessment cycles can be strategic

Senior and Low-Income Programs

- Most municipalities offer deferral programs for eligible seniors

- Income-based assistance programs available in many communities

- Application deadlines vary by municipality

- Programs typically require annual renewal

Understanding property tax obligations is essential for accurate budgeting and informed

purchase decisions. While higher-tax municipalities may offer lower purchase prices, the

long-term cost of ownership must consider these ongoing expenses. Working with real

estate professionals familiar with the tax implications across different GTA communities

can help buyers make decisions aligned with their financial goals and lifestyle preferences.